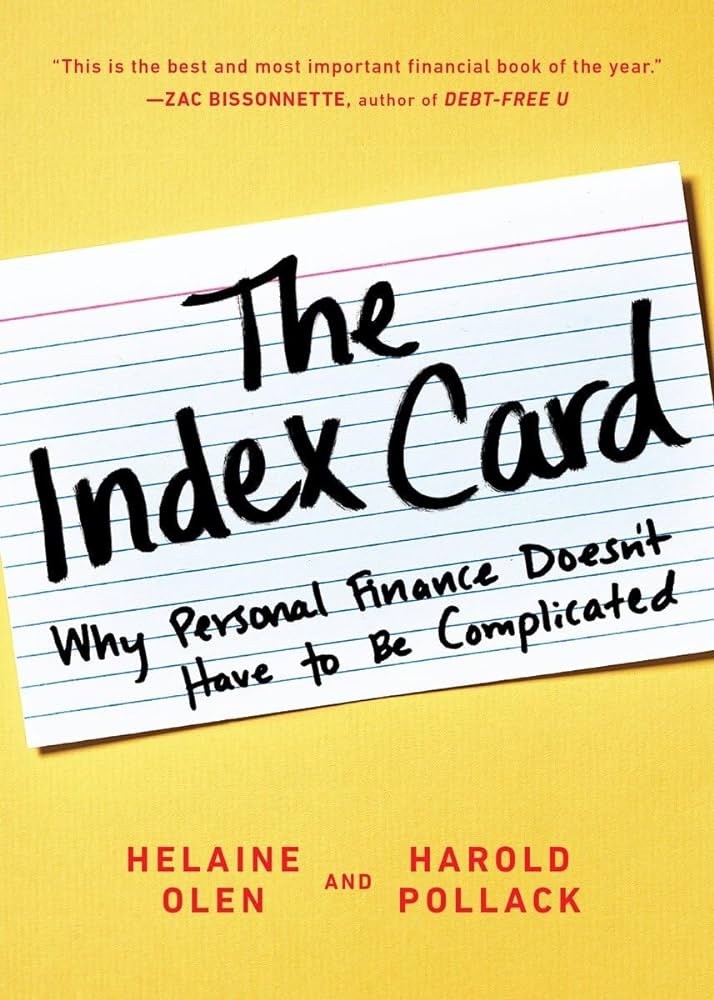

In an era where personal finance seems more convoluted than ever, "The Index Card: Why Personal Finance Doesn't Have to Be Complicated" offers a refreshing perspective. Authored by Helaine Olen, a financial journalist, and Harold Pollack, a professor of social service administration, this book presents a straightforward approach to managing one's finances without drowning in complexity.

The premise of "The Index Card" is simple yet profound: all the financial advice you need can fit onto a single index card. This premise challenges the prevailing notion that managing money requires intricate strategies and sophisticated investments. Instead, Olen and Pollack advocate for a back-to-basics approach rooted in timeless principles.

At the core of their philosophy is the idea that financial well-being is achievable for everyone, regardless of income or background. The book emphasizes ten key rules for financial success, each succinctly summarized on the titular index card. These rules encompass fundamental concepts such as living within your means, saving for the future, and avoiding high-cost financial products.

One of the book's strengths is its accessibility. Olen and Pollack eschew jargon and technical language in favor of plain, relatable prose. This makes the book approachable for readers with varying levels of financial literacy, from novices to seasoned investors. Moreover, the authors supplement their advice with real-life examples and anecdotes, further illustrating the practical application of their principles.

A central theme of "The Index Card" is the importance of simplicity. Olen and Pollack argue that the financial industry often thrives on complexity, enticing consumers with a dizzying array of products and services. However, they caution against falling for these traps, advocating instead for a stripped-down approach focused on low-cost, diversified investments.

One of the book's most compelling arguments is in favor of index funds—a type of investment vehicle that tracks a market index, such as the S&P 500. Olen and Pollack contend that index funds offer several advantages over actively managed funds, including lower fees and greater long-term returns. By investing in index funds, they argue, individuals can achieve solid investment results without the need for constant monitoring or expert-level knowledge.

Critics of "The Index Card" may argue that its advice oversimplifies complex financial issues. Indeed, some aspects of personal finance, such as tax planning or retirement withdrawal strategies, may require more nuanced approaches. However, Olen and Pollack acknowledge these limitations, emphasizing that their book provides a foundation upon which readers can build a more sophisticated financial understanding.

Ultimately, "The Index Card" offers a compelling alternative to the often-confusing world of personal finance. By distilling financial wisdom into ten simple rules, Olen and Pollack empower readers to take control of their financial lives with confidence. Whether you're just starting on your financial journey or seeking to simplify your existing approach, this book serves as a valuable guide to achieving financial security and peace of mind.